Does an Executor Have to Give an Accounting in California?

When someone passes away in California with a will-based estate plan, their estate must pass through the California probate process. The executor named in their will is tasked with managing and settling the deceased person’s estate, paying off debts, and distributing assets to the beneficiaries. One common question asked by beneficiaries is: Does an executor have to give an accounting in California?

The short answer is yes—but with a few caveats. Let’s break it down.

What Is an Executor’s Accounting?

An executor’s accounting is essentially a detailed report showing how the estate’s assets were managed, what expenses were incurred, and how the assets were ultimately distributed. This accounting serves as a transparent way to inform beneficiaries of the estate’s financial status and the executor’s actions during the administration process.

When Is an Executor Required to Provide an Accounting?

Under California law, an executor is required to provide a formal accounting to beneficiaries in certain situations. If the estate is being administered under court-supervised probate, the executor must file an accounting with the court. This accounting typically includes:

- A list of all assets in the estate at the beginning of the probate process, including real property, bank accounts, investments, and personal property

- Income or gains the estate has received

- Any debts or liabilities paid out of the estate

- A detailed record of expenses incurred during the estate administration

- A breakdown of how the remaining assets will be or have been distributed to beneficiaries

The probate court reviews this information, and beneficiaries have the right to see it and raise any objections if necessary.

When Might an Executor Not Be Required to Give an Accounting?

In cases where a formal probate is not necessary, the executor may not be required to provide a detailed court accounting. This may include a very small estate that qualifies for simplified probate procedures, such as a small estate affidavit. However, beneficiaries may still have a right to request an informal accounting.

If all the beneficiaries agree, they can waive the requirement for a formal accounting, allowing the probate process to move faster so they can receive their inheritance sooner. Beneficiaries should carefully consider whether they want to waive this right, as it limits their ability to challenge the executor’s actions later.

What If an Executor Fails to Provide an Accounting?

If an executor refuses to provide an accounting when required, beneficiaries can take legal action. Beneficiaries can petition the court to compel the executor to provide an accounting. If the court finds that the executor has acted improperly or failed in their duties, the executor may be removed and possibly held financially responsible for any losses to the estate.

Beneficiaries’ Rights to Information

Beyond formal accountings, an executor has a duty to keep the beneficiaries informed about the estate administration. Even if a formal accounting is not required, beneficiaries can request information from the executor regarding estate assets and expenses. The executor has a fiduciary duty to act in the best interest of the beneficiaries, which includes providing information upon reasonable request.

Waiver of Account

If all beneficiaries of the estate are willing to waive their rights to an accounting, they can sign a waiver of account and file it with the court. However, the executor will still have to provide a schedule of gains and losses on the estate value of assets. Otherwise, the court may reduce the amount of their statutory fee compensation.

Key Takeaways

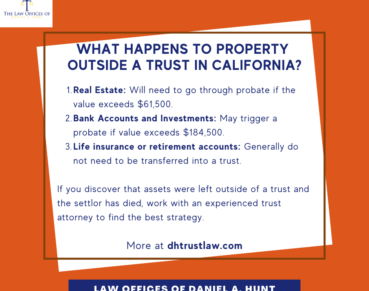

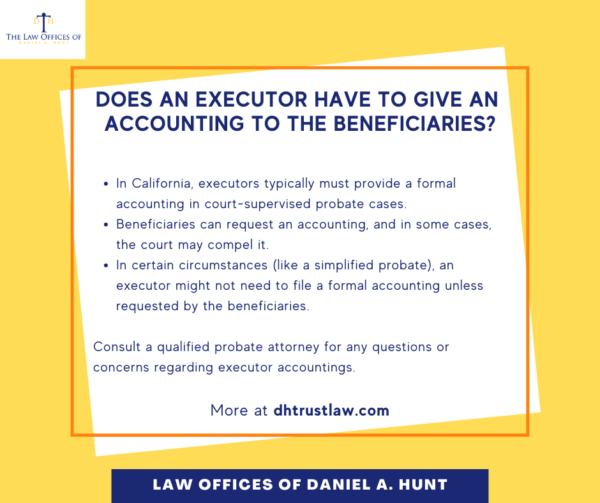

- In California, executors typically must provide a formal accounting in court-supervised probate cases.

- Beneficiaries can request an accounting, and in some cases, the court may compel it.

- In certain circumstances, such as simplified probate, an executor might not need to file a formal accounting unless requested by the beneficiaries.

- Beneficiaries should carefully evaluate whether to waive the right to an accounting, as it limits their ability to challenge the estate’s management.

Seek Legal Counsel

Estate administration can be complex, and ensuring that the executor fulfills their fiduciary duties is critical. If you are a beneficiary and have concerns about the administration of an estate, or if you’re an executor unsure of your responsibilities, consulting with an experienced probate attorney can provide clarity and help you avoid potential disputes.

If you have any questions like, “Does an Executor Have to Give an Accounting in California?”, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.